Mortgage Shopping and Credit Scores

by Lisa Prevost (New York Times: 02/01/2015)

Borrowers need not avoid shopping around for the best mortgage deal out of fear that allowing multiple lenders to “pull,” or check, their credit will chip away at their score.

The notion that a flurry of credit inquiries from mortgage lenders will lower a borrower’s score is a common misconception, experts say. The truth is that five inquiries are likely to have no more impact than one, provided they are made within a compressed period of time.

When it comes to mortgages, as well as automobile financing and student loans, “in both the FICO and VantageScore credit-scoring systems, there is logic in place that protects consumers’ credit scores from any negative impact caused by multiple inquiries as a result of rate shopping,” said John Ulzheimer, a credit expert with Credit Sesame, a website that helps consumers manage credit.

With FICO (the scoring model required by Fannie Mae and Freddie Mac), credit inquiries for mortgage loans that are less than 30 days old are ignored and have no impact, Mr. Ulzheimer said. Inquiries older than 30 days are looked at, but multiple inquiries from mortgage lenders made within 45 days of one another are treated as one inquiry. With VantageScore, the window is 14 days.

Both scoring systems assume that if someone has multiple mortgage-related inquiries in a short period, they are likely shopping for the best deal on a single mortgage, Mr. Ulzheimer said.

If one of the multiple mortgage inquiries occurs outside the allowed window — say, on day 46 — it would be counted as a second inquiry. “But it probably wouldn’t hurt you even then,” said Daniel

Credit card applications can work against your score, however, and consumers would be wise not to open charge accounts around the time they are hoping to get a mortgage. Mr. Sater advises people to pay down existing credit cards well before applying with mortgage lenders.

They should also review their credit report ahead of time, because if there are inaccuracies or problems, “it takes a while to get rid of those things,” Mr. Sater noted.

Once borrowers know their credit scores (roughly, anyway, since scores shown to consumers may not be exactly the same as those used by lenders), they can use them on online lending exchanges like Bankrate andLendingTree to obtain loan quotes without going through the preapproval process that triggers credit inquiries.

Douglas R. Lebda, the founder and chief executive of LendingTree, which has a network of more than 300 lenders, says borrowers should be able to trust the accuracy of the mortgage quotes provided — as long as they tell the truth when filling out the lending form. “Our quotes are very precise — we’re pulling from the lenders’ real pricing systems,” he said. “You’re getting a real offer, so you shouldn’t have to apply with more than one on Lending Tree.”

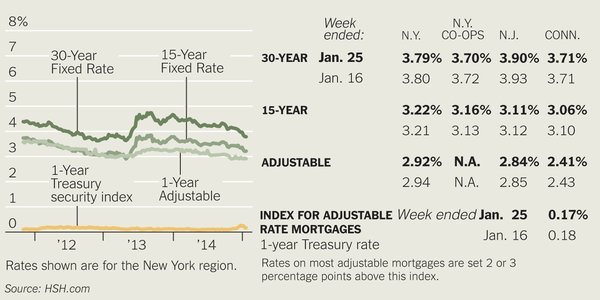

When comparing offers, borrowers should also pay attention to the type of loan being offered — is the rate fixed for the life of the loan, or is it variable?

But they should not get carried away in the hunt for the best deal, Mr. Sater said. At some point, they’re effectively “looking for the biggest liar,” meaning if a rate sounds too good to be true, it may be that the loan officer or broker is not being totally forthcoming. The bottom line, he said, is “how much do you trust the loan officer you’re dealing with? It pays to spend time interviewing the loan officer, rather than just concentrating on rates.”

A version of this article appears in print on February 1, 2015, on page RE7 of the New York edition with the headline: Loan Shopping and Credit Scores.