Wall Street Journal: January 15, 2015

Falling Rates Spur Revival in Market for Mortgages

By JOE LIGHT and ANNAMARIA ANDRIOTIS

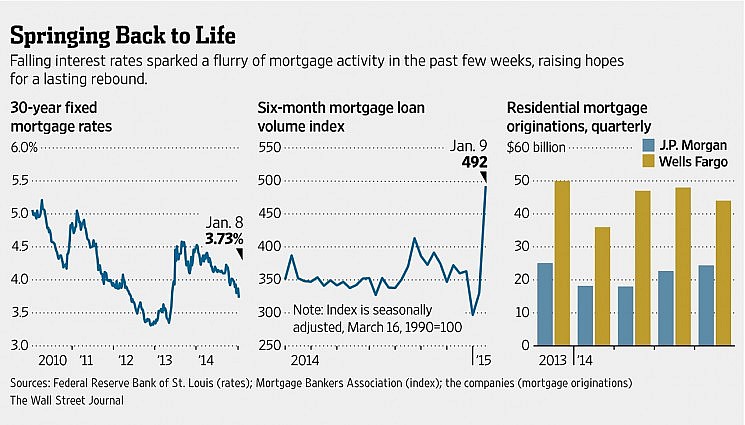

The moribund mortgage market suddenly sprang back to life last week after a drop in interest rates to levels not seen in almost two years sent borrowers rushing to lock in cheaper loans.

Mortgage applications rose a seasonally adjusted 49% in the week ended Jan. 9 from the previous week and 30% from a year ago, according to data from the Mortgage Bankers Association. Application volume touched its highest level since August 2013, with most of the increase driven by borrowers seeking to refinance.

Why It Might Be Time To Refinance Your Mortgage

Nearly Half of Home Buyers Don’t Shop Around for Mortgages

The real test for the market will come in the next few weeks. If mortgage rates continue to fall, refinancings could pick up, breathing more life into the mortgage market. It is unclear, however, whether the uptick will prove the beginning of a lasting trend. Mortgage-application estimates can be volatile around holiday weeks, making them less reliable as an indicator of an underlying trend.

Some brokers and lenders say there has been a perceptible increase in activity in the past few weeks as borrowers try to take advantage of the unexpected drop in interest rates. On Wednesday, the yield of the 30-year Treasury bond fell to a record, while 10-year Treasury yields declined to their lowest level since May 2013, as weak U.S. consumer spending added to global economic worries.

In the week ended last Thursday, the average rate on a 30-year fixed-rate mortgage was 3.73%, its lowest since May 2013, according to Freddie Mac .

Refinancing could be bolstered further by an Obama administration decision last week to cut the fees charged by a federal loan program popular among first-time home buyers. The U.S. Department of Housing and Urban Development estimates that 100,000 to 200,000 borrowers could refinance loans guaranteed by the program this year.

Adam Spuler, a 36-year-old owner of a roofing and remodeling company, bought his home in Lutz, Fla., about 18 months ago using a 30-year fixed-rate mortgage of roughly $315,000 at a 5.25% interest rate.

Mr. Spuler said he applied to refinance his mortgage on Saturday with Wyndham Capital Mortgage Inc., which is offering him a 30-year fixed-rate loan at 4.375%. He said the rate he is currently paying is higher than what he would have otherwise been able to get because he made only a 10% down payment for the home. He is expecting his appraisal to show that the home’s value has gone up enough to give him a 20% equity stake in the property, which would qualify him for this lower rate.

“I’m not going to put more cash down, but the homes in my area have appreciated,” he said.

Last week’s increase still leaves weekly volume 52% shy of its recent peak in 2012.

Between 2009 and mid-2013, refinance applications surged, bolstering banks’ mortgage businesses even as home-purchase lending activity dried up. In 2012, lenders refinanced $1.456 trillion of mortgages, accounting for 71% of mortgage originations, according to the MBA.

But after Federal Reserve officials hinted in May 2013 that the end of their bond-buying economic-stimulus program would come soon, interest rates shot up and refinancings cratered, accounting for just 42% of mortgage volume during the first three quarters of 2014, according to the MBA, the latest data available.

The pool of borrowers who would benefit from a refinancing has shrunk with each new period of low rates. Now, more than two-thirds of fixed-rate mortgages that are government backed have an interest rate of 4.5% or below, according to an MBA analysis of data on the mortgage market from J.P. Morgan Chase & Co. and Deutsche Bank AG.

That, in turn, has made lenders increasingly reliant on home purchases to drive their mortgage businesses, and lately, the housing market has looked sluggish, said Doug Duncan, chief economist for mortgage-finance company Fannie Mae.

“We have to see strong and sustained income growth before we’re going to see housing make a significant move upward,” Mr. Duncan said. A Fannie Mae survey in December found that only 64% of consumers thought it was a good time to buy a home, tying an all-time low for the survey, which was started in 2010.

J.P. Morgan and Wells Fargo & Co. on Wednesday delivered mixed news on mortgage originations in their fourth-quarter results.

J.P. Morgan, the largest U.S. bank by assets, said originations, while down 1% from a year ago, rose 8% from the third quarter, although the end of the year is typically a slow period. Last year, the bank reduced its mortgage-banking head count by more than 7,500 employees.

Originations at Wells Fargo, the fourth-largest U.S. bank by assets, fell from the previous quarter, although the bank said the decline in rates could drive more mortgages in the first part of the year.

“If rates stay low or are favorable, surely we could see more activity,” said Wells Fargo Chairman and Chief Executive John Stumpf during an earnings call.

Smaller lenders also say they are seeing more activity.

A spokeswoman for Navy Federal Credit Union, the largest U.S. credit union by assets, said it has received $267 million in refinance applications this month through Tuesday, versus $293 million in refinance applications received for the entire month of January 2014.

Stephen Thorne, a branch manager with River Community Bank NA in Raleigh, N.C., said his office in the past few days has made about 100 calls to potential clients who could save money by refinancing. Mr. Thorne said he believes “this refinance window will be short lived.”

Adam Lowry, a 35-year-old physician in Washington, D.C., bought his house in April 2014, taking out a 30-year fixed-rate mortgage with a 4.125% rate on which he owes almost $590,000. He said he contacted several lenders this week and has been told he can get rates ranging from 3.675% to 4% on the same loan. He said he is planning to keep the home for a long time and will likely rent it out when he moves. “I’m thinking long term, so I’m trying to get the lowest rate I can on a 30-year fixed for the potential benefits of having [the home] as an investment,” said Mr. Lowry.

Write to Joe Light at joe.light@wsj.com